The 8-Minute Rule for What Is 1031 Exchange California

Table of Contents1031 Exchange Rules Fundamentals ExplainedAn Unbiased View of 1031 ExchangeLittle Known Questions About What Is A 1031 Exchange.All About 1031 Exchange RulesSome Known Details About 1031 Exchange Rules California 2022

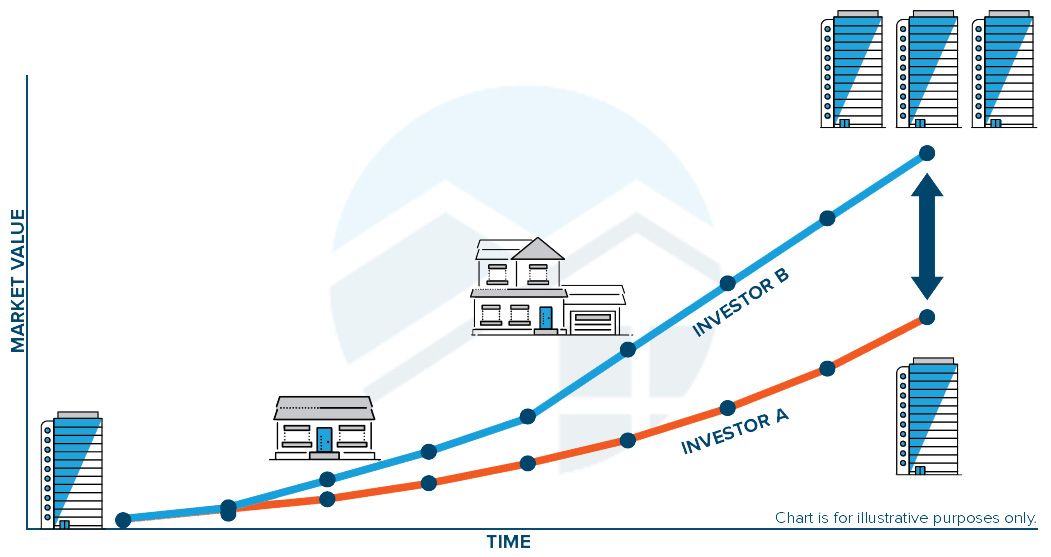

1031 Exchanges have a very rigorous timeline that needs to be adhered to, and also normally need the support of a certified intermediary (QI). Consider a tale of 2 financiers, one who used a 1031 exchange to reinvest earnings as a 20% down payment for the following property, as well as an additional that made use of resources gains to do the very same point: We are using round numbers, omitting a great deal of variables, and also thinking 20% complete appreciation over each 5-year hold duration for simplicity.This table likewise does not make up existing cash circulation produced during each hold duration, which would most likely be greater when making use of 1031 exchanges to increase acquiring power for every reinvestment. After two decades, the expected portfolio value of $1,920,000 when going after a 1031 exchange strategy compares positively with a predicted worth of only $1,519,590 when paying capital gains taxes along the method.

Here's advice on what you canand can't dowith 1031 exchanges. # 3: Review the Five Common Kinds of 1031 Exchanges There are 5 usual kinds of 1031 exchanges that are usually utilized by investor. These are: with one residential property being soldor relinquishedand a replacement residential property (or properties) bought throughout the allowed home window of time. over at this website.

Some Known Incorrect Statements About Capital Gains Taxes In California

The intermediary can not be somebody who has actually worked as the exchanger's agent, such as your staff member, lawyer, accounting professional, lender, broker, or realty representative (click reference). It is best technique nonetheless to ask one of these people, commonly your broker or escrow policeman, for a reference for a certified intermediary for your 1031.

The three primary 1031 exchange policies to comply with are: Substitute residential property should be of equal or greater value to the one being sold Replacement building should be identified within 45 days Replacement building have to be purchased within 180 days Greater or equivalent value replacement property rule In order to maximize a 1031 exchange, real estate investors must identify a substitute propertyor propertiesthat are of equal or better worth to the residential property being offered.

Little Known Facts About 1031 Exchange Rules California.

That's since the internal revenue service only enables 45 days to determine a substitute home for the one that was marketed. In order to get the ideal price on a replacement residential property experienced real estate financiers don't wait till their building has been marketed before they begin looking for a substitute.

The probabilities of obtaining an excellent rate on the building are slim to none. 180-day home window to purchase substitute residential property The purchase as well as closing of the replacement building have to take place no behind 180 days from the time the current residential property was offered. Bear in mind that 180 days is not the very same thing as 6 months.

Our What Is A 1031 Exchange California Diaries

To keep points simple, we'll presume 5 things: The current home is a multifamily building with a price basis of $1 million The market value of the building is $2 million There's no home mortgage on the property Costs that can be paid with exchange funds such as payments and also escrow fees have been factored right into the expense basis The capital gains tax rate of the homeowner is 20% Marketing realty without utilizing a 1031 exchange In this instance allow's pretend that the real estate capitalist is tired of owning property, has no beneficiaries, as well as selects not to seek a 1031 exchange.

8% web investment tax obligation on high earners + any type of added state resources gains taxes depending upon where the home lies. In California, the state funding gains tax obligation responsibility can be as high as an additional 13. 3%, or an additional $133,000! Marketing realty making use of a 1031 exchange Instead, we 'd utilize a 1031 tax-deferred exchange and follow these steps: Market the existing multifamily building and send out the $1M continues out of escrow straight to a 1031 exchange facilitator.

5 million, as well as an apartment for $2. 5 million. 1031 exchange real estate. Within 180 days, you could do take any kind of one of the following actions: Acquisition the multifamily structure as a replacement home worth a minimum of $2 million as well as defer paying resources gains tax obligation of $200,000 Purchase the 2nd apartment or condo structure for $2.

Our 1031 Exchange Fund Statements

5 million as well as pay $100,000 in capital gains tax on the taxable gain (or boot) of $500,000 Purchase the purchasing facility with an additional home for a complete replacement worth of greater than $2 million and postpone paying resources gains tax obligation # 6: Job to Remove Resources Gains Tax Permanently 1031 exchanges deferor placed off to the futurethe payment of collected capital gains tax - click to read.

Which only goes to show that the saying, 'Nothing makes certain other than death and also tax obligations' is just partly real! look at this website To Conclude: Things to Keep In Mind regarding 1031 Exchanges 1031 exchanges permit investor to postpone paying capital gains tax when the proceeds from property offered are used to purchase replacement genuine estate. 1031 exchange.

Rather than paying tax obligation on capital gains, investor can place that additional money to function promptly as well as enjoy greater current service income while expanding their portfolio quicker than would certainly or else be feasible.